If you are rich enough your estate will pay a 40% tax above the exemption

UNIFIED TAX CONCEPT

Under the federal estate taxes and gift taxes laws, the amount that one gives away during one’s lifetime counts toward the entire exclusion from estate and gift taxes. The lifetime estate and gift tax exclusion is now at $5 million per person indexed for inflation. For 2014 the exclusion is $5,340,000 per person. There is a federal estate tax of 40% of the net asset value of the estate over 5,340,000. Thus, if a person dying in 2014 has $6,340,000 in net asset value, he would have $1 million taxable and the tax would be $400,000. Under the unified tax concept, the exclusion is reduced for whatever gifts are made over and above the annual gift tax exclusion amount. Thus, one cannot escape estate taxes by giving away once estate prior to death.

The term “irrevocable trust” is commonly used by estate lawyers and financial planners to describe a trust which is permanent and cannot be changed or revoked.

The term “irrevocable trust” is commonly used by estate lawyers and financial planners to describe a trust which is permanent and cannot be changed or revoked. Orange County Estate Planning Lawyer Blog

Orange County Estate Planning Lawyer Blog

The term “living trust” is commonly used by estate lawyers and financial planners to describe a trust which is established during a person’s lifetime and which is revocable and changeable.

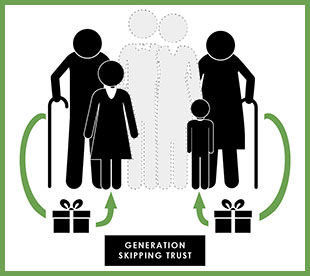

The term “living trust” is commonly used by estate lawyers and financial planners to describe a trust which is established during a person’s lifetime and which is revocable and changeable. A Generation Skipping Trust (GST) is a generic term for any trust where there are trust benefits which are skipping a generation. A typical example is where a Trustor establishes a trust that does not benefit his children but instead benefits his grandchildren. Thus, the trust “skips” giving anything to the Trustor’s children. The law imposes a “Generation Skipping Tax” of a flat 40% on certain transfers above an exemption amount to insure that property transfers are subject to transfer tax at least once at each generation. The exemption amount is the same as the estate tax exemption amount which for 2014 is $5,325,000. The relevant IRC sections are §2601 through §2642.

A Generation Skipping Trust (GST) is a generic term for any trust where there are trust benefits which are skipping a generation. A typical example is where a Trustor establishes a trust that does not benefit his children but instead benefits his grandchildren. Thus, the trust “skips” giving anything to the Trustor’s children. The law imposes a “Generation Skipping Tax” of a flat 40% on certain transfers above an exemption amount to insure that property transfers are subject to transfer tax at least once at each generation. The exemption amount is the same as the estate tax exemption amount which for 2014 is $5,325,000. The relevant IRC sections are §2601 through §2642.

Real estate property ownership is legally changed by a document commonly known as a deed which is signed by the person making the ownership transfer. The deed is then recorded with the County recorder in the county where the property is located.

Real estate property ownership is legally changed by a document commonly known as a deed which is signed by the person making the ownership transfer. The deed is then recorded with the County recorder in the county where the property is located.